RBI Monetary Policy: Repo Rate, Inflation and GDP Growth; Know Key Highlights

By Lokmat English Desk | Published: April 5, 2024 11:16 AM2024-04-05T11:16:32+5:302024-04-05T11:17:21+5:30

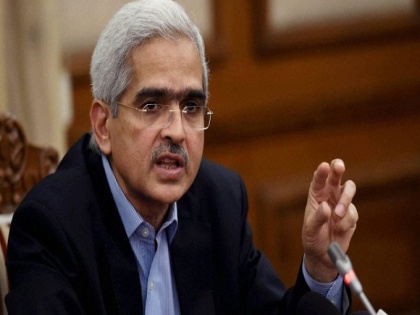

The Reserve Bank of India (RBI) Governor, Shaktikanta Das, has announced the Monetary Policy Committee's (MPC) decision on interest ...

RBI Monetary Policy: Repo Rate, Inflation and GDP Growth; Know Key Highlights

The Reserve Bank of India (RBI) Governor, Shaktikanta Das, has announced the Monetary Policy Committee's (MPC) decision on interest rates following a two-day review meeting of the central bank's MPC, the rate-setting panel. The meeting, which commenced on April 3 and concluded on April 5, marks the first MPC announcement in the Financial Year 2024-25 (FY25). The RBI Governor has opted to maintain the repo rate at 6.5 per cent, marking the seventh consecutive time that the rate has remained unchanged. The repo rate signifies the rate at which the central bank lends money to banks for the short term.

What statement did the RBI governor said regarding the repo rate?

The RBI governor stated that the MPC will closely monitor food inflation. Additionally, the six-member rate-setting panel predominantly supported maintaining the current interest rates, with a majority vote of 5:1, while also prioritizing the gradual withdrawal of the accommodative stance.

What did the RBI governor make regarding GDP growth?

The RBI governor announced that the GDP growth forecast for FY25 remains unchanged, with the estimate retained at 7 per cent for the current fiscal year.

What Shaktikanta Das said on inflation?

On the inflation front, the RBI MPC sees it at 4.5 percent for FY25. He said, Inflation is on a declining trajectory and GDP growth is buoyant. At this juncture we should not lower our guard but continue to work towards ensuring that inflation aligns durably to the target.

What transpired during the RBI's Monetary Policy Committee meeting in February?

In its most recent review held in February 2024, the RBI chose to maintain the status quo on policy rates and stances. However, the decision was not unanimous, as one member suggested a 25 basis points rate cut