Amazon food delivery service poses risk to incumbents: Motilal Oswal

By ANI | Published: March 10, 2021 03:15 PM2021-03-10T15:15:50+5:302021-03-10T15:25:02+5:30

Amazon's foray into food delivery poses a risk to incumbents but the impact on Zomato or Swiggy's duopoly will be marginal, according to Motilal Oswal.

Amazon food delivery service poses risk to incumbents: Motilal Oswal

Amazon's foray into food delivery poses a risk to incumbents but the impact on Zomato or Swiggy's duopoly will be marginal, according to Motilal Oswal.

It said Amazon Food will pose a risk to both players as it can shake up established set ups with a focus on profitability.

Amazon's entry into public food delivery market is currently limited to Bengaluru with coverage in 62 out of 250 pin codes in which it had internally conducted trials in four-pin codes a year ago.

The initial rollout has primarily been with restaurant chains in Bengaluru and is yet to expand aggressively to small independent restaurants. The company has tied up with 2,500 restaurants while Zomato has 15,000 within Bengaluru only.

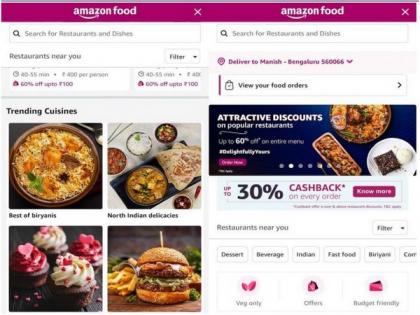

The food delivery is through a tab built-in the flagship Amazon app, visible only to customers located in delivery regions.

Motilal Oswal's initial channel checks of restaurants in Bengaluru suggest that Amazon is charging a take rate of 10 per cent on order value from restaurant partners, which is less than half of what the duo (Zomato and Swiggy) charge from restaurants -- 22 to 25 per cent -- which has increased over the years.

Apart from early deliveries on online shopping, exclusive deals, and video or audio content, food delivery is another angle for entry into the prime ecosystem.

The company will consistently keep take-rates below the industry average as its key focus in India remains its prime membership, which should allow it to sustain losses in the food delivery business, according to the release.

According to the report, Amazon's expansion can pose a risk to Zomato's road to profitability and lead to higher losses from investee compes' on Infoe's consolidated profit and losses. "We foresee a risk to the duopoly structure and consistently take rates in the industry as Infoe holds 18.4 per cent stake in Zomato."

( With inputs from ANI )

Disclaimer: This post has been auto-published from an agency feed without any modifications to the text and has not been reviewed by an editor

Open in app