Edelweiss CEO reveals she started investing for son in SIP when he turned 6 months old

By Lokmat English Desk | Published: August 17, 2023 01:22 PM2023-08-17T13:22:39+5:302023-08-17T13:22:54+5:30

Radhika Gupta, the managing director and chief executive officer of Edelweiss Asset Management Company (AMC), recently revealed that she ...

Edelweiss CEO reveals she started investing for son in SIP when he turned 6 months old

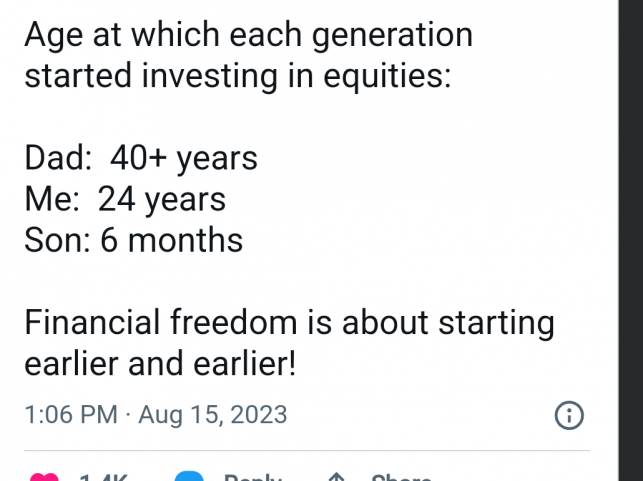

Radhika Gupta, the managing director and chief executive officer of Edelweiss Asset Management Company (AMC), recently revealed that she started a systemic investment plan (SIP) for her son when he was just six months old. Taking to microblogging site X (formerly known as Twitter), Ms Gupta revealed the age at which each generation in her family started investing in equities. While she began investing for her son when he was just six months old, she herself began investing in equities only at the age of 24. Her father, on the other hand, was over the age of 40 when he began building his portfolio, Ms Gupta said.

Age at which each generation started investing in equities: Dad: 40+ years. Me: 24 years. Son: 6 months," Radhika Gupta tweeted, adding, "Financial freedom is about starting earlier and earlier!"Since being posted, Ms Gupta's tweet has caught the attention of many on social media. In the comment section, while some users agreed with her investment plan, others asked questions regarding SIPs. SIP stands for Systematic Investment Plan. SIP is an investment method that allows you to invest a fixed amount regularly (daily/weekly/monthly or quarterly) in a mutual fund scheme. Think of it as a disciplined fitness plan for your finances.

Let's say, Radhika decides to invest Rs 5,000 monthly into a mutual fund. This strategy not only makes his investment manageable but also mitigates the risk of market volatility. This principle, known as rupee cost averaging, allows Radhika to buy more units when prices are low and fewer when prices are high, potentially lowering the average cost of his investment over time.The flexibility of SIP is another advantage. Raj can adjust his investment amount as his financial situation changes, and set the frequency of his investment as per his convenience - monthly, quarterly, or even weekly. In a nutshell, a SIP is like a reliable guide in your investment journey, helping you navigate market volatility with regular and disciplined investments. Whether you're a novice or a seasoned investor, a SIP can be a strategic tool to build wealth over time. In a SIP, a fixed sum of money is deducted from your bank account periodically (monthly, quarterly, etc.) and invested into a specific mutual fund of your choice. The number of units you acquire depends on the mutual fund's Net Asset Value (NAV) at the time of investment. When NAVs are low, you get more units, and when NAVs are high, you get fewer units. This approach is known as rupee cost averaging and can help mitigate the impact of market volatility.

Open in app