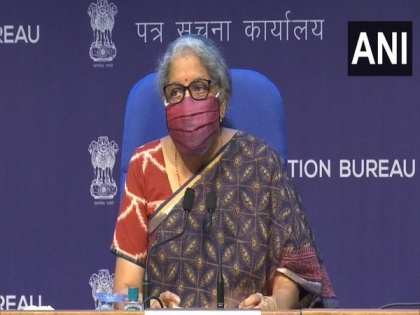

Compliance burden of small, medium-sized taxpayers reduced: Nirmala Sitharaman

By ANI | Published: May 28, 2021 09:57 PM2021-05-28T21:57:02+5:302021-05-28T22:05:02+5:30

In major decisions taken by the GST Council today, compliance burden of small taxpayers and medium-sized taxpayers has been reduced and an amnesty scheme has been recommended for reducing late fee payable, to provide relief to small taxpayers, informed Union Finance Minister Nirmala Sitharaman on Friday.

Compliance burden of small, medium-sized taxpayers reduced: Nirmala Sitharaman

In major decisions taken by the GST Council today, compliance burden of small taxpayers and medium-sized taxpayers has been reduced and an amnesty scheme has been recommended for reducing late fee payable, to provide relief to small taxpayers, informed Union Finance Minister Nirmala Sitharaman on Friday.

Speaking to reporters after chairing the 43rd GST Council meet, she said, "One of the biggest decisions today is reduction of compliance burden of small taxpayers and medium-sized taxpayers. Late fee and amnesty-related matters were also decided upon. To provide relief to small taxpayers, an amnesty scheme was recommended for reducing late fee payable in these cases."

According to the Union Finance Minster, taxpayers can now file their pending returns and avail the benefits of this amnesty scheme with reduced late fees.

"Late fees have also been rationalised. The rationalised late fee and the decision to reduce the maximum amount of late fee for small taxpayers will come into effect for future tax periods. This will provide a long-term relief to small taxpayers," said Sitharaman.

The Central Government is in touch with suppliers/manufacturers including the Japanese and European Union for COVID-19 vaccines and a sum of Rs 4,500 crores has already been paid to two vaccine manufacturers as advance payment, informed Sitharaman on Friday.

Speaking to reporters after chairing the 43rd GST Council meet, she said, "Rs 4,500 crores were paid to two vaccine manufactures, as advance payment. The country is engaging with suppliers/manufacturers including Japanese, European Union for vaccines. In the coming months, supply will be more than what it is."

She further informed that due to rising cases of black fungus, Amphotericin B has also been included in the exemptions list.

She also stated that issue of COVID-related equipment was one of the items on the agenda that was discussed.

"Issues of COVID-related equipment was one of the items on the agenda that was discussed. Many issues were raised and discussed....The council has decided to exempt the import of relief items till 31 August 2021," said Sitharaman.

The Finance Minister said, "Ad hoc exemptions have been given for COVID-related equipment. The council has decided to exempt the import of many of these items with exemption extended to August 31, 2021."

Sitharaman announced that a Group of Ministers has been formed who will submit their report within 10 days on whether any further reductions need to be done.

"We've decided and announced in council that a Group of Ministers will be quickly formed who will submit their report within 10 days on or before 8 June, so that if there are any further reductions which need to be done will be done, in the sense, that rates will be decided by them," said the Finance Minister.

( With inputs from ANI )

Disclaimer: This post has been auto-published from an agency feed without any modifications to the text and has not been reviewed by an editor

Open in app