In Rajya Sabha, Oppn seeks raise in bank deposit insurance, crack down on spurious cough syrups

By IANS | Updated: December 3, 2025 13:50 IST2025-12-03T13:44:57+5:302025-12-03T13:50:11+5:30

New Delhi, Dec 3 During Zero Hour in the Rajya Sabha on Wednesday, Neeraj Dangi of Congress strongly ...

In Rajya Sabha, Oppn seeks raise in bank deposit insurance, crack down on spurious cough syrups

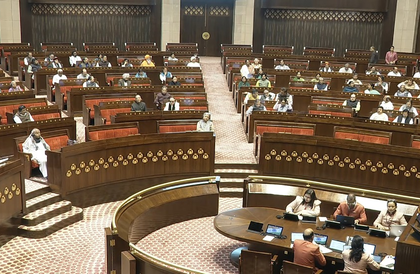

New Delhi, Dec 3 During Zero Hour in the Rajya Sabha on Wednesday, Neeraj Dangi of Congress strongly criticised the inadequacy of the current Rs 5 lakh deposit insurance cover provided by the Deposit Insurance and Credit Guarantee Corporation (DICGC) and demanded that the limit be immediately raised to at least Rs 25 lakh per depositor.

“In case any bank (commercial or cooperative) fails, every type of deposit -- savings, current, fixed deposit (FD), or recurring deposit -- of every depositor is insured only up to Rs 5 lakh, irrespective of the total amount deposited. The entire risk of amounts above Rs 5 lakh is borne by the depositor alone. The Rs 5 lakh limit was fixed on February 4, 2020, after the Punjab & Maharashtra Co-operative Bank (PMC Bank) crisis. Before that, it was only Rs one lakh for decades, as per the latest DICGC report (March 2024)," Dangi said.

“Out of 1,497 insured banks, only 43.8 per cent of total deposits are fully covered under the present Rs 5 lakh limit. A shocking 56.2 per cent of the total depositable amount remains completely uninsured. Most of the uninsured money belongs to senior citizens and elderly people who deposit their lifelong savings in banks for security. If even one major urban cooperative or small finance bank fails, the hard-earned money of thousands of senior citizens could vanish overnight,” the member pointed out.

“In the last year alone (2023-24), 431 urban cooperative banks have either failed or come under severe stress,” he said.

In the PMC Bank-like crisis, DICGC had to pay approximately Rs 17,000 crore to lakhs of depositors, he pointed out. “The premium for this insurance (currently 0.12 per cent paid by banks and not charged to customers) should continue to be borne entirely by the banks,” without passing any burden to depositors, he said, adding that raising deposit insurance will ensure more faith in the banking system.

Also, Shiv Sena(UBT) Rajya Sabha MP Priyanka Chaturvedi on Wednesday raised the issues on the rising menace of food adulteration and sub-standard/spurious medicines across the country, describing it as a “national health emergency that is claiming innocent lives every day”.

Raising the issue during Zero Hour, the MP said she had already written to the Union Health Minister on this subject, and she once again requested the government through the House -- the scale at which food adulteration and contaminated medicines are spreading has crossed all limits.

“Right from contaminated cough syrups that have been taking the lives of infants, that are being prescribed by doctors and low-quality medicines available freely in the market. As well as the food adulteration that leads to cancer across the country needs to be brought under control, and we need to have stricter measures and punitive action against those who are flouting these norms,” she said.

Disclaimer: This post has been auto-published from an agency feed without any modifications to the text and has not been reviewed by an editor

Open in app