Union Budget 2024: Explained How Employees Will Save Rs 17,500 From Salaries With New Budget Provisions

By Lokmat English Desk | Updated: July 23, 2024 15:44 IST2024-07-23T15:42:25+5:302024-07-23T15:44:12+5:30

Union Finance Minister Nirmala Sitharaman presented the Union Budget for 2024-25, introducing tax relief measures for taxpayers opting for ...

Union Budget 2024: Explained How Employees Will Save Rs 17,500 From Salaries With New Budget Provisions

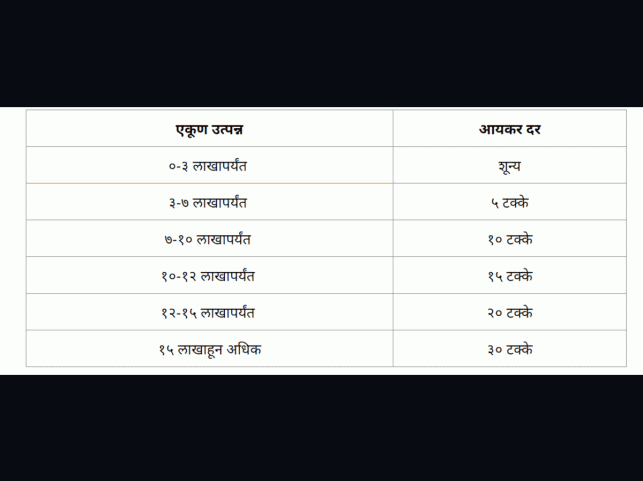

Union Finance Minister Nirmala Sitharaman presented the Union Budget for 2024-25, introducing tax relief measures for taxpayers opting for the new tax regime. Significant revisions include adjustments to income tax slabs and rates, with the standard deduction raised from Rs 50,000 to Rs 75,000. Additionally, income up to Rs 3 lakh will now be exempt from taxation under the new regime.

Potential Salary Savings

The Finance Minister announced that the recent adjustments to income tax slabs in the budget could lead to a savings of up to Rs 17,500 for salaried people.

How Will It Benefit?

Income tax expert CA Kamlesh Kumar explains the advantages of the new provision: "Consider Ghanshyam, who earns an annual salary of Rs 10 lakh and has opted for the new tax regime. Under last year's system, his tax liability, including cess, was Rs 54,600. With the revised provisions, his tax liability will now be reduced to Rs 44,200, encompassing both income tax and cess."

Understanding the Savings: An Example

Consider Ghanshyam, who earns Rs 10 lakh annually. Last year, he received a standard deduction of Rs 50,000, reducing his taxable income to Rs 9.5 lakh. Under the previous tax regime:

- Income up to Rs 3 lakh was tax-free.

- The next Rs 3 lakh (Rs 3-6 lakh) was taxed at 5%, amounting to Rs 15,000.

- The subsequent Rs 3 lakh (Rs 6-9 lakh) was taxed at 10%, totaling Rs 30,000.

- The remaining Rs 50,000 (Rs 9-9.5 lakh) was taxed at 15%, resulting in Rs 7,500.

This led to a total income tax of Rs 52,500. Including a 4% cess of Rs 2,100, Ghanshyam’s total tax liability was Rs 54,600.

Revised Tax Liability

Under the new tax provisions, Ghanshyam’s annual income remains Rs 10 lakh, but the standard deduction has increased to Rs 75,000, reducing his taxable income to Rs 9.25 lakh. Here’s how his tax liability changes:

- Income up to Rs 3 lakh remains tax-free.

- The next Rs 4 lakh (Rs 3-7 lakh) is taxed at 5%, totaling Rs 20,000.

- The remaining Rs 2.25 lakh (Rs 7-9.25 lakh) is taxed at 10%, amounting to Rs 22,500.

The total tax before cess is Rs 42,500. Adding a 4% cess of Rs 1,700, his total tax liability is Rs 44,200. Compared to last year, this represents a savings of Rs 10,400.

Open in app