Anil Ambani's Reliance Power and Reliance Infra Stocks Surge Following ₹526 Crore Arbitration Win

By Lokmat Times Desk | Updated: August 14, 2025 12:47 IST2025-08-14T12:44:53+5:302025-08-14T12:47:12+5:30

Shares of Anil Ambani-owned Reliance Power and Reliance Infrastructure witnessed significant gains today, following the announcement of a favorable ...

Anil Ambani's Reliance Power and Reliance Infra Stocks Surge Following ₹526 Crore Arbitration Win

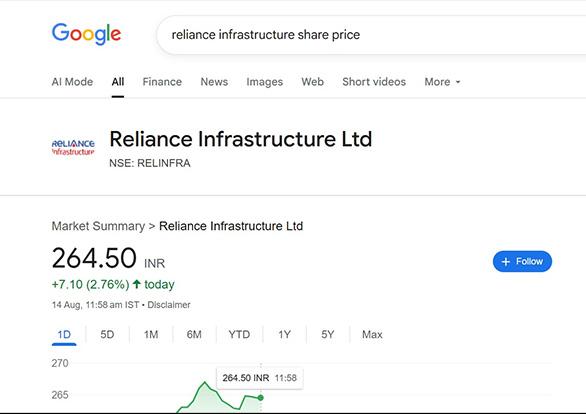

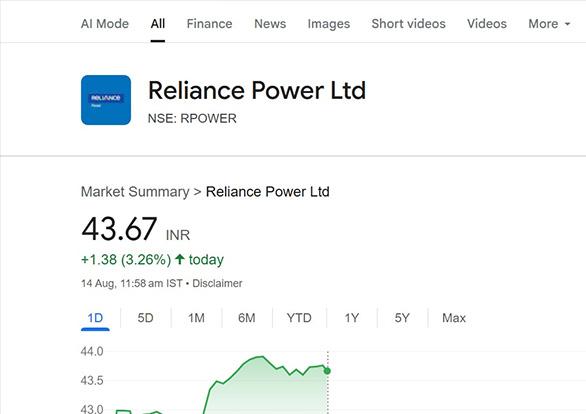

Shares of Anil Ambani-owned Reliance Power and Reliance Infrastructure witnessed significant gains today, following the announcement of a favorable arbitration ruling yesterday. Reliance Power jumped by ₹1.48 (3.50%), reaching ₹43.77, up from ₹42.29 the previous day. Similarly, Reliance Infra rose by ₹6.15 (2.39%), climbing to ₹263.55, up from ₹257.40. This surge comes after the Anil Dhirubhai Ambani Group (ADAG) secured an arbitration award worth ₹526 crore against Aravali Power Company Private Limited (APCPL). The dispute arose from the alleged wrongful termination of a contract by APCPL in 2018, which the Ambani group contested through arbitration proceedings.

The Arbitral Tribunal, by a majority decision, ruled that the termination of the contract was invalid. In line with this ruling, the Tribunal awarded a sum of ₹526 crore in favor of Reliance Infrastructure. The company confirmed the award, stating, “A three-member Arbitral Tribunal, by a majority award, has held that the termination by APCPL was illegal, invalid, and wrongful, and partly allowed the company’s claims towards damages and costs incurred due to the wrongful termination. The award in favor of the company is for a sum of ₹526.23 crore, along with interest.” The proceeds from this award will be used by Reliance Infrastructure to further strengthen its financial position and fund growth initiatives.

Financial Resurgence and Debt-Free Status

Reliance Power and Reliance Infrastructure have been at the center of investor attention in recent times, particularly due to their remarkable financial recovery. This year has brought good fortune for Anil Ambani, with his companies making substantial progress in clearing debts. Sasan Power Limited, a subsidiary of Reliance Power, repaid its $150 million (₹1286 crore) loan to IIFCL, becoming debt-free. Earlier, Anil Ambani had cleared debts worth thousands of crores across various Reliance Group companies, significantly strengthening the balance sheets of his businesses, particularly Reliance Power, the flagship company of his conglomerate.

In June 2025, Reliance Power announced that it had become a debt-free company on a standalone basis, having cleared all outstanding dues to lenders. The company, which had a debt of around ₹800 crore, repaid this amount to various banks. Between December 2023 and March 2024, Reliance Power signed multiple debt settlement agreements with IDBI Bank, ICICI Bank, Axis Bank, and DBS, successfully repaying all its debts to these institutions. Similarly, Reliance Infrastructure achieved a significant milestone by reducing its standalone net debt from banks and financial institutions to zero. This reduction amounted to approximately ₹3,300 crore during FY25. The group also highlighted its nearly debt-free status, reporting net worths of ₹14,883 crore and ₹16,431 crore for Reliance Power and Reliance Infra, respectively, as of July 2025.

The Role of Jai Anmol and Jai Anshul Ambani in the Group’s Revival

The recent revival of Anil Dhirubhai Ambani Group is largely attributed to the efforts of Anil Ambani's sons, Jai Anmol Ambani and Jai Anshul Ambani. Both sons have taken up leadership roles within the indebted conglomerate and have been instrumental in driving the resurgence of their father's business empire. Their efforts have included securing new deals and significantly reducing the group’s massive debt burden. Jai Anmol Ambani, the elder son, made attempts to revive Reliance Capital, but despite his best efforts, he was unable to save the debt-ridden company from going bankrupt. Eventually, Reliance Capital was taken over by the Hinduja Group’s IndusInd International Holdings Ltd (IIHL).

Meanwhile, Jai Anshul Ambani, the younger son, has been instrumental in steering the group’s focus toward new ventures. He is assisting with the development of Reliance Nippon Life Insurance and Reliance Capital Asset Management.

Open in app