Bulandshahr confectioner receives Rs 141 crore Income Tax notice, FIR lodged over misuse of documents

By IANS | Updated: September 1, 2025 19:10 IST2025-09-01T19:05:33+5:302025-09-01T19:10:20+5:30

Bulandshahr (Uttar Pradesh), Sep 1 In a bizarre case, a small confectioner in Uttar Pradesh's Bulandshahr district has ...

Bulandshahr confectioner receives Rs 141 crore Income Tax notice, FIR lodged over misuse of documents

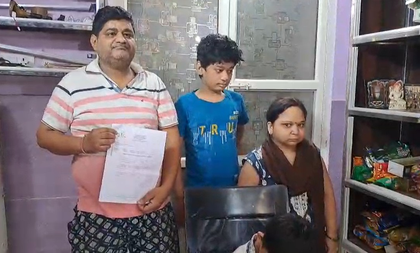

Bulandshahr (Uttar Pradesh), Sep 1 In a bizarre case, a small confectioner in Uttar Pradesh's Bulandshahr district has been served an Income Tax (IT) notice of Rs 141 crore, leaving his family shocked and distressed.

Sudhir Gupta, who runs a modest sweet shop in the Nayaganj area of Khurja Nagar Kotwali in Bulandshahr, received a notice from the Income Tax Department accusing him of tax evasion amounting to Rs 1,41,28,47,126.

Gupta said his family went into shock on seeing the notice. He said that he had never carried out such massive transactions.

"It is unimaginable. I am just a small businessman. I have never done business of crores, let alone billions of rupees. Suddenly, such a big notice came, and my entire family is devastated," Gupta told IANS.

Preliminary investigations have revealed that some Delhi-based companies allegedly misused Gupta’s Aadhaar and PAN cards to conduct transactions worth billions of rupees.

The victim filed a written complaint at the local police station, following which an FIR was registered and an investigation initiated.

Gupta added that this was not the first such incident -- he had received a similar notice in 2022 as well.

"We request the police to ensure justice and take strict action against the culprits. It seems someone used my Aadhaar and PAN to open firms and carry out huge transactions without paying taxes," Gupta added.

Police officials said the matter is under investigation and assured the family that corrective action would be taken.

Meanwhile, Gupta continues to live under stress, awaiting clarity from authorities.

Cybercrime experts have warned that the fake identification and forged documents point to organised networks of criminal activity, often targeting small traders and labourers who are not digitally literate.

Disclaimer: This post has been auto-published from an agency feed without any modifications to the text and has not been reviewed by an editor

Open in app