With ₹257.77 crore invested, Electronics Development Fund supported 128 Indian startups

By ANI | Updated: November 15, 2025 12:10 IST2025-11-15T12:09:39+5:302025-11-15T12:10:04+5:30

New Delhi [India], November 15 : The central government has so far supported as many as 128 startups nationwide ...

With ₹257.77 crore invested, Electronics Development Fund supported 128 Indian startups

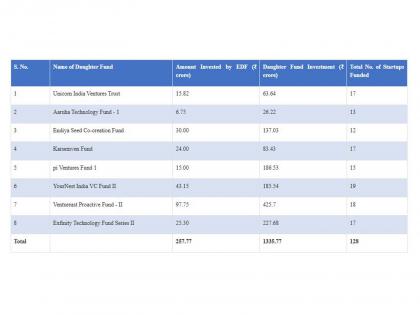

New Delhi [India], November 15 : The central government has so far supported as many as 128 startups nationwide with an investment of Rs 257.77 crore under the Electronics Development Fund (EDF).

To strengthen momentum in India's electronics sector and nurture a robust innovation ecosystem, the government launched the Electronics Development Fund (EDF) on February 15, 2016.

The Fund was launched to promote research, development, and entrepreneurship in the fields of electronics, nanoelectronics, and information technology.

The EDF functions as a Fund of Funds, designed to invest in professionally managed Daughter Funds such as early-stage angel and venture funds. These Daughter Funds, in turn, provide risk capital to startups and companies developing new technologies.

By doing so, the EDF played a crucial role in building a self-sustaining electronics ecosystem that encourages innovation, product design, and intellectual property creation within the country, according to a statement from PIB Headquarters on Saturday.

The supported startups operate in frontier areas such as Internet of Things (IoT), Robotics, Drones, Autonomous Vehicles, HealthTech, Cyber Security, and Artificial Intelligence and Machine Learning, the statement noted.

"EDF has been established to create a strong foundation for innovation and research in India's electronics and information technology sectors. It aims to strengthen the ecosystem by supporting funds that provide risk capital to startups and companies engaged in developing cutting-edge technologies," the statement read.

Each Daughter Fund supported under the scheme is required to be registered in India and comply with all applicable laws and regulations, including the SEBI (Alternative Investment Funds) Regulations, 2012, as Category I or Category II AIFs. This ensures that all participating funds operate within a well-defined regulatory framework while aligning with EDF's broader goal of fostering research, entrepreneurship, and technological advancement.

A total of 368 Intellectual Properties (IPs) have been created or acquired by the supported startups, it said. Out of the 128 supported startups, Daughter Funds have exited from 37 investments. The cumulative returns received by EDF from exits and partial exits stand at Rs 173.88 crore, the statement noted.

Disclaimer: This post has been auto-published from an agency feed without any modifications to the text and has not been reviewed by an editor

Open in app