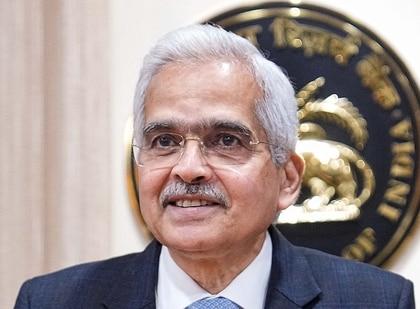

RBI Monetary Policy: Will your EMI Decrease or Increase? Governor Shaktikanta Das to Announce Monetary Policy Decision Soon

By Lokmat English Desk | Published: February 8, 2024 09:28 AM2024-02-08T09:28:18+5:302024-02-08T09:29:47+5:30

As the Reserve Bank of India (RBI) deliberates on potential adjustments to the repo rate, borrowers are on edge, ...

RBI Monetary Policy: Will your EMI Decrease or Increase? Governor Shaktikanta Das to Announce Monetary Policy Decision Soon

As the Reserve Bank of India (RBI) deliberates on potential adjustments to the repo rate, borrowers are on edge, anticipating fluctuations in loan interest rates. Today marks the conclusion of the RBI's Monetary Policy Committee meeting, which began on February 6 and concludes on February 8. The imminent announcement will reveal whether EMIs will rise or fall. Despite government efforts to reduce the deficit and stimulate interest rate reductions, experts remain cautious about the likelihood of any significant decreases.

Economists and banking professionals speculate that rate cuts may not materialize until the latter half of the year. This time around, optimism for rate cuts is also low. Nevertheless, the Reserve Bank finds reassurance in the gradual decline of inflation and the positive momentum of the economy.

During the last MPC, for the fifth consecutive time, the RBI maintained the repo rate at 6.5 percent. The last adjustment occurred in February 2023, increasing the rate from 6.25 percent. The upcoming decision, following the Interim Budget, remains uncertain. This marks the first MPC meeting of 2024, following the presentation of Interim Budget 2024. Expectations are widespread that the committee will uphold the current repo rate at 6.5 percent, continuing a trend seen in the past five decisions. This stance aims to align to achieve a 4 percent Consumer Price Index (CPI) inflation target

Open in app