Former Insurance Ombudsman Atul Jerath Released his New Book on Policyholder Challenges and Systemic Reforms

By ANI | Updated: April 23, 2025 16:17 IST2025-04-23T16:12:12+5:302025-04-23T16:17:08+5:30

VMPL New Delhi [India], April 23: "The Insurance Ombudsman's Perspective" written by Atul Jerath was released on 17 April, ...

Former Insurance Ombudsman Atul Jerath Released his New Book on Policyholder Challenges and Systemic Reforms

VMPL

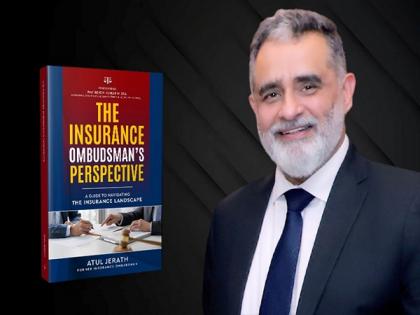

New Delhi [India], April 23: "The Insurance Ombudsman's Perspective" written by Atul Jerath was released on 17 April, 2025. The book's release also coincided with his birthday. The launch event, attended by family, friends, and colleagues from the insurance fraternity, marked the debut publication of a seasoned industry insider with over four decades of experience.

In an era where insurance is becoming an essential pillar of personal and financial security, an ex-Insurance Ombudsman has provided a candid and rare insight into the operations of India's grievance redressal system in his debut book.

Atul Jerath, leveraging his illustrious four-decade career in public insurance and his tenure as the Insurance Ombudsman at Chandigarh, explores the systemic issues that policyholders often face, ranging from denial of claims and mis-selling to lack of communication and low awareness of rights.

Far from a critique, the book serves as a constructive reflection aimed at initiating dialogue among stakeholders. The book's interest is heightened by its foundation in actual cases, managed during a three-year period that witnessed the promise and limitations of the present redressal mechanisms.

The author brings to light fine-grained patterns: denial of claims on technical grounds, high-value policies sold without adequate underwriting, and mandatory policy bundling at the time of loan processing. The book also prompts sincere reflection among regulators and insurers, questioning whether current frameworks are actually in sync with the needs of policyholders, which are changing over time.

As the insurance industry is being rapidly digitized and growing, such reflections come with timely significance. Industry players and lawyers have said the book's best aspect is not finger-pointing, but its advocacy of empathetic systems, better consumer protection, and a more powerful institution of the Insurance Ombudsman. Instead of dictating what should be done, the writer urges all stakeholdersinsurers, intermediary groups, policyholders, and policymakersto think, engage in discussion, and create a system based on fairness and trust.

Published by White Falcon Publishing, the book is available for purchase on Amazon worldwide channels -

Amazon: https://shorturl.at/G7trD

WFP Store: https://shorturl.at/QZF2I

(ADVERTORIAL DISCLAIMER: The above press release has been provided by VMPL.will not be responsible in any way for the content of the same)

Disclaimer: This post has been auto-published from an agency feed without any modifications to the text and has not been reviewed by an editor

Open in app