GST revenues up 9.1 pc at Rs 1.89 lakh crore in Sep

By IANS | Updated: October 1, 2025 17:20 IST2025-10-01T17:19:10+5:302025-10-01T17:20:14+5:30

New Delhi, Oct 1 India’s goods and services tax (GST) revenues rose 9.1 per cent year-on-year in September, ...

GST revenues up 9.1 pc at Rs 1.89 lakh crore in Sep

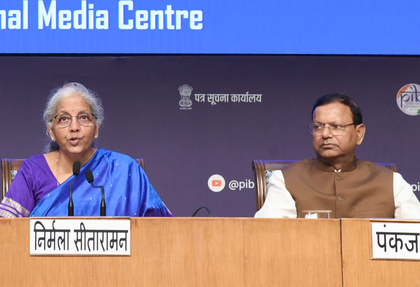

New Delhi, Oct 1 India’s goods and services tax (GST) revenues rose 9.1 per cent year-on-year in September, reaching Rs 1.89 lakh crore, according to government data released on Wednesday.

This marks the fastest growth rate in four months and extends the streak of monthly inflows above Rs 1.8 lakh crore to nine consecutive months. The pickup is also the fastest in four months, compared with 6.5 per cent growth in August.

Notably, gains were recorded despite weak consumer spending on non-durables, with buyers postponing purchases in anticipation of GST rate cuts.

In the second quarter of FY26, collections reached Rs 5.71 lakh crore, a 7.7 per cent increase year-over-year, but slower than the 11.7 per cent growth witnessed in the previous quarter.

Recognising the need to strengthen domestic growth drivers amid these heightened external sector risks, the government has announced a rationalisation of the GST regime. This move is expected to lower the tax burden on consumers, boost consumption, and provide a cushion against tariff impacts. Additionally, it is likely to improve demand visibility for firms, enabling them to expand investment in additional capacities.

Meanwhile, the Reserve Bank of India on Friday revised India's growth forecast upward by 30 bps to 6.8 per cent from its earlier projection. S&P Global Ratings earlier this month maintained that the economy will continue to grow at 6.5 per cent, with domestic demand partially offsetting the impact of US tariffs.

Buoyant tax collections in recent months have helped to strengthen the country’s fiscal position and the macroeconomic fundamentals, which help to ensure stable growth.

Centre introduced a two-slab GST rate of 5 and 18 per cent on most goods, while a separate higher 40 per cent tax was imposed on sin goods such as cigarettes, tobacco, and sugary drinks as part of the rationalisation exercise.

Disclaimer: This post has been auto-published from an agency feed without any modifications to the text and has not been reviewed by an editor

Open in app