Where Should I Invest in my early 30's?

By Impact Desk | Updated: August 23, 2023 13:22 IST2023-08-23T13:20:51+5:302023-08-23T13:22:15+5:30

The financial freedom and growth that most yearn for aren't solely about hoarding wealth—it's about making that wealth work ...

Where Should I Invest in my early 30's?

The financial freedom and growth that most yearn for aren't solely about hoarding wealth—it's about making that wealth work overtime for you. A recent CNBC study demonstrates the substantial difference starting early can make in an investment strategy. By investing ₹15,000 monthly at age 35, they could accumulate around ₹3.66 crores by age 65, assuming a 15% annual return. But if they start at 30, they could amass nearly ₹6.92 crores, a significant 63% increase. With this in mind, we delve into the best investment plan in India for those entering their 30s.

1. Assessing Financial Goals

Carving out your financial goals is a critical maiden step on your investment journey. These goals are personalized and can significantly shape the investment choices you make.

Short-term Goals: These are financial objectives aimed to accomplish within a few years. Includes planning a luxury holiday, buying a new car, or building an emergency fund.

Long-term Goals: These financial ambitions span many years and may include aspirations like home ownership, saving for your child's education, or retirement planning.

Applying the 'S.M.A.R.T' framework can aid in setting effective goals, ensuring they are Specific, Measurable, Achievable, Relevant, and Time-bound.

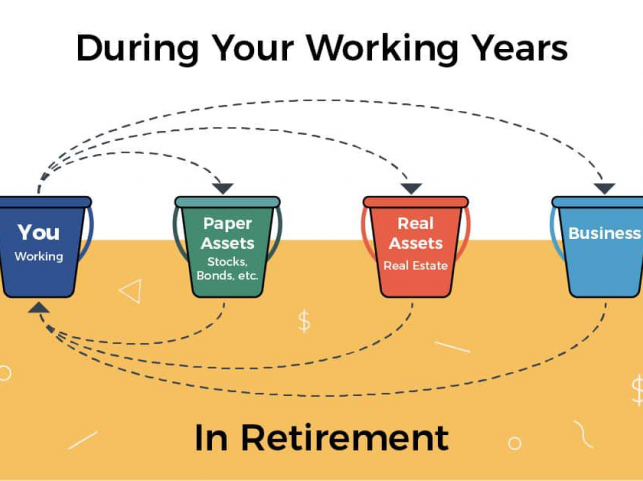

2. Retirement Planning

Although retirement might seem distant in your 30s, early planning offers numerous benefits. It allows ample time to build a substantial corpus for your non-earning phase.

National Pension System (NPS): A government-backed retirement scheme, NPS is an excellent choice for creating a retirement corpus. These contributions are eligible for tax deductions and offer a mix of equity and debt investments.

Employees Provident Fund (EPF): If you are salaried, part of your salary probably goes into an EPF account. Building a retirement fund is one of the safest and risk-free investment choices.

3. Equity Investments for Growth

Equity investments can provide significant long-term growth, despite carrying a higher risk than other assets. This makes them a key part of the best investment plan in India portfolio for those in their early 30s.

Equity Mutual Funds: They primarily invest in various company shares, offering diversification, professional management, and convenience for investors lacking the time or expertise to monitor the stock market directly.

Direct Stock Investments: When you understand the intricacies of the stock market and accept the higher-risk scenarios, direct stock investments offer substantial returns.

4. Systematic Investment Plans (SIPs)

SIPs are ideal for disciplined, regular investments. They automate the investment process in mutual funds at regular intervals, ensuring consistency and affordability.

- Rupee Cost Averaging: SIPs can help mitigate market volatility impact.

- Disciplined Investing: SIPs foster financial discipline by committing you to contribute regularly.

- Affordable: SIPs can start with a small amount, making them accessible to various investors.

5. Real Estate Investments

Investing in real estate in your 30s offers both financial growth and stability. It's a tangible asset that can provide rental income and potential appreciation over time.

- Rental Income: Purchasing a property for rental purposes can provide a steady income stream.

- Capital Appreciation: Over the long term, property prices could be higher than the initial purchase price.

- Tax Benefits: Home loans for buying a property come with certain tax benefits. Principal repayments on a home loan are eligible for tax deductions, as is the interest component, subject to certain conditions.

6. Emergency Fund and Insurance

A robust financial plan not only focuses on wealth accumulation but also on protecting existing assets.

- Emergency Fund: This financial safety net covers 3-6 months of living expenses.

- Insurance: Adequate health and life insurance is crucial to cover potential risks that could otherwise derail your financial plans.

7. Tax Planning and Tax-Saving Investments

Tax planning has become an essential part of financial planning. There are several tax-saving best investment plans in India available:

- Public Provident Fund (PPF): A long-term investment option that offers attractive interest rates.

- Equity Linked Saving Scheme (ELSS): These are tax-saving mutual funds with a 3-year mandatory lock-in period.

- Tax-Saving Fixed Deposits: A 5-year fixed deposit with a bank allows for tax deductions.

It is important to diversify your investments and consult with a financial advisor to create a plan that is tailored to your individual needs and goals.

Conclusion

Your 30s present a prime opportunity to start building your financial future. Wisely navigating your investment options can lay the foundation for fiscal well-being in your later years.Ensuring a diversified mix of strategies tailored to your financial goals, such as risk tolerance and investment horizon, is crucial. Investing means growing your wealth and securing future financial comfort for those you care about.

Open in app