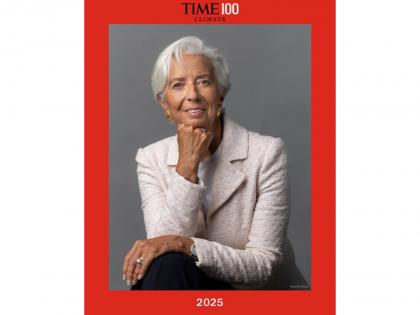

ECB President Christine Lagarde expresses gratitude after featuring on TIME100 Climate list

By ANI | Updated: November 2, 2025 22:10 IST2025-11-02T22:09:01+5:302025-11-02T22:10:09+5:30

Brussels [Belgium], November 2 : European Central Bank (ECB) President and former International Monetary Fund chief Christine Lagarde has ...

ECB President Christine Lagarde expresses gratitude after featuring on TIME100 Climate list

Brussels [Belgium], November 2 : European Central Bank (ECB) President and former International Monetary Fund chief Christine Lagarde has expressed appreciation after being featured on the third annual TIME100 Climate list.

"I am deeply grateful to be recognised on the third annual #TIME100Climate list," Lagarde, who has been heading the ECB since 2019, wrote in a post on X.

{{{{twitter_post_id####}}}}I am deeply grateful to be recognised on the third annual #TIME100Climate list.

At the @ecb, we show that accelerating the clean energy transition is essential for a secure, sustainable and affordable future for Europe, and for safeguarding our price stability mandate. pic.twitter.com/oRFawlEOnO

— Christine Lagarde (@Lagarde) November 2, 2025

Emphasising the ECB's commitment to climate action, she said, "At the @ecb, we show that accelerating the clean energy transition is essential for a secure, sustainable and affordable future for Europe, and for safeguarding our price stability mandate."

Lagarde, who has positioned climate change at the heart of monetary policymaking, is steering the ECB toward tackling the crisis by reshaping Europe's financial systems rather than relying solely on environmental regulation.

In July, the ECB revealed that beginning in the latter half of 2026, it will adjust how it values assets from high- and low-emission companies when banks borrow money. The initiative seeks to shield the Eurosystem from potential losses linked to climate transition risks.

This approach means that when financial institutions borrow from the Central Bank, the worth of their collateral will depend on the environmental footprint of the companies behind those assets. Securities tied to polluting sectors will be assigned a lower value, making it costlier for banks to lend to such industries.

"We don't have the luxury of time. Our work shows that the longer we wait to address the climate crisis, the higher the economic costs and financial risks will be," Lagarde says.

The reform highlights Lagarde's determination to embed climate awareness into the ECB's broader mission. While the US Federal Reserve has reduced its role in international climate initiatives, Lagarde has remained steadfast in integrating climate priorities into monetary policy.

The ECB has also instructed European banks to monitor and manage their climate-related exposures, warning of penalties for non-compliance.

Under Lagarde's leadership, the ECB has become one of the first central banks globally to directly factor environmental impact into its operational framework.

"Climate change and the green transition have an impact on inflation. That's why they are directly relevant for our price stability mandate," she says. "This will help us keep prices stable and banks safe."

Disclaimer: This post has been auto-published from an agency feed without any modifications to the text and has not been reviewed by an editor

Open in app