What Is ULI? RBI to Launch New Digital Payments System Unified Lending Interface, Similar to UPI

By Lal Mohmmad Shaikh | Updated: August 26, 2024 11:10 IST2024-08-26T10:55:58+5:302024-08-26T11:10:41+5:30

The Reserve Bank of India (RBI) governor Shaktikanta Das on Monday, August 26, said the features of the central ...

What Is ULI? RBI to Launch New Digital Payments System Unified Lending Interface, Similar to UPI

The Reserve Bank of India (RBI) governor Shaktikanta Das on Monday, August 26, said the features of the central bank’s project for a public tech platform for frictionless credit that he said will now be called Unified Lending Interface (ULI). ULFI for frictionless credit is now in its pilot stage and will be launching soon nationwide.

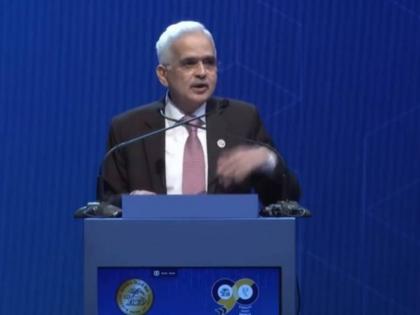

Speaking at the inauguration of the Global DPI and Emerging Tech Conference, RBI Governor Shaktikanta Das said that the central bank had initiated a tech platform for enabling frictionless credit. The invention is still in a pilot project he said. "India’s experience provides an effective digitisation strategy for other central banks...DPI has enabled India to achieve financial inclusion in a decade, which otherwise could have taken many years," he added.

The RBI continues working on digital payment systems to make the financial sector stronger. However, he also alerted fianancial institutions of the rise of Artificial intelligence (AI). Das said, "CBDC has the potential to underpin future payment systems, cross border payments. Integration of Al in financial services will bring opportunities for all stakeholders. Financial institutions must be careful with the adoption of Al such as loan sanctioning Ministry of Electronics taking initiatives to tackle potential challenges."

"Last year we launched a pilot of a technology platform which enables frictionless credit and this initiative is very important for all policymakers, for all authorities, whether they are from governments or central banks, or they are private banks or private financial companies. This initiative, which we launched last year, is still in the pilot mode and it's a technology platform for enabling frictionless credit. From now on, we propose to call it the Unified Lending Interface, that is ULI," the RBI governor said.

What Is ULI?

RBI Governor Shaktikanta Das said that the feature of ULI is to give seamless flow of digital information. The platform will provide land records of various states from multiple data service providers to lenders.

#WATCH | During the inaugural address at Global DPI and Emerging Tech Conference, RBI Governor Shaktikanta Das says, "Based on our experience from the pilot project, a nationwide launch of the Unified Lending Interface (ULI) will be done in due course."

— ANI (@ANI) August 26, 2024

He further adds, "Last… pic.twitter.com/jZhwJp6IEe

"This platform facilitates a seamless flow of digital information, including even land records of various states, from multiple data service providers to lenders. This cuts down the time taken for credit appraisal, especially for smaller and rural borrowers...Based on our experience from the pilot project, a nationwide launch of the ULI will be done in due course. Just like the UPI transforms the payments ecosystem, we expect that ULI will play a similar role in transforming the lending ecosystem in India," He further added.

He said that the launch of the Unified Payment Interface (UPI) in April 2016 by the National Payments Corporation of India (NPCI), has played a significant role in the growth of digital payments in India.

What ULI Will Do?

A Unified Lending Interface will reduce the time for credit appraisal for small and medium borrowers. The entire ULI digital system is consent-based and will protect data. It will also reduce complications of multiple technology integration.

ULI will play a similar role to UPI in transforming the lending ecosystem in India. The new trinity of JAM, UPI and ULI will be a revolutionary step forward in India's digital journey

Open in app