Kerala's outstanding debts cross Rs 3 lakh crore

By IANS | Published: February 26, 2022 12:00 PM2022-02-26T12:00:20+5:302022-02-26T13:24:48+5:30

Thiruvananthapuram, Feb 26 On the eve of Kerala's new State Finance Minister K.N. Balagopal preparing the text of ...

Kerala's outstanding debts cross Rs 3 lakh crore

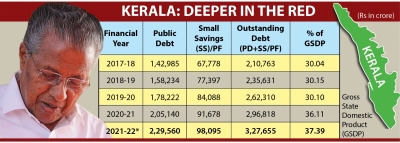

Thiruvananthapuram, Feb 26 On the eve of Kerala's new State Finance Minister K.N. Balagopal preparing the text of his first full state budget on March 11, the biggest cause of concern is the state's mounting outstanding debts, which according to the budget for 2021-22 will be Rs 3.27 lakh crore by the end of this fiscal.

Outstanding debts is the sum total of public debt which consists of internal debt, loans and advances from centre besides loans from financial institutions such as LIC and special securities and not to mention of borrowings from deposits in state PF, treasury, pension funds and insurance.

Even when the overall picture of Kerala's finances was never rosy, it took a severe blow like the rest of the world with the Covid pandemic, leaving the cash crunched state in an even piquant position.

To get a clearer picture of the debt, it is best highlighted as a ratio of the size of the state economy/state gross state domestic product (GSDP).

A comparison of the national picture of states and union territories with the highest debt GSDP ratio in 2022 are Arunachal Pradesh 57.4 per cent, Kashmir 56.6, Punjab 53.3, Nagaland 44.2, Himachal Pradesh 43.4, Rajasthan 39.8, Meghalaya 39.2, West Bengal 38.8, Kerala 38.3 and Andhra Pradesh 37.6.

One thing what has to be noted is the present staggering figure of the outstanding debts of Kerala did not happen overnight and successive state governments to a certain extent can take credit for the achievements of the state in the fields of education and health, which leads the rest of the country and to reach here, investment is required, but looking deeper into it experts revealed the real situation.

K.J. Joseph, director of the capital city headquartered Gulati Institute of Finance and Taxation (GIFT) said in the aftermath of Covid pandemic the countries across the world could be divided into two categories. In the first category, there are countries that managed to record a V shaped recovery and in the other group are countries for whom the pre-pandemic position still remains a distant dream.

"The countries that managed to achieve the V shaped recovery are the ones that substantially invested through fiscal policy measures in saving the life and livelihood of the people on the one hand and made significant investment towards ensuring sustained economic growth inter alia through investment in infrastructure of all kinds, including health infrastructure, investment in new generation technologies including low carbon technologies, industry and in greening the economy," pointed out Joseph.

He goes on to say that as a result the global debt today stands at $224 trillion according to IMF and the debt GDP ratio is presently at the highest level in the last 50 years.

"In this context, if the public debt of a state like Kerala that managed to display a globally acclaimed performance in the pandemic period shall not be a matter of much surprise. Kerala social sector expenditure recorded and increase of 162 per cent when compared to 30 per cent at the national level. Thanks to the increased health expenditure mortality rate in Kerala, the geriatric state of the country, during the pandemic was the lowest among the states in India and lower compared to developed countries. Thus viewed, the high public debt is a price that the state had paid for saving the life and livelihood of the people during the pandemic," said Joseph whose institute is envisaged as a centre of excellence, specializing in research, training and consultancy, to provide fiscal and social policy inputs to the Government of Kerala in particular and the South Indian states in general

He goes on to point out that at the same time, Kerala is not the highest indebted state in the country and there are at least four states having high the ratio of interest to the total revenue than our state.

"Analytically the pandemic like conditions are the situations where in the state needs to come forward as has happened in the developed countries during the pandemic and the fear of debt shall not be deterrent to borrowing so long as we ensure ‘quality spending," added Joseph.

Senior economist Pyarelal Raghavan said that huge borrowings to balance the income and expenditure have been an important feature of both the union and state government budgets.

"The result has been a growing debt burden which has increased the payments for interest and repayment of principal. Recent estimates made by the RBI for 2021-22 show that the total debt or outstanding liabilities of the states and union territories is Rs 69.47 lakh crore which is 31.2 per cent of the GDP. In contrast the debt to GDP ratio of the union government was 59.3 per cent of GDP in 2020-21," said Raghavan.

He added that the interest burden is to be paid out of the revenue receipts of the states the burden of interest payment is usually estimated as a share of the revenue receipts of the states.

"The ratio of interest payment to revenue receipts for the states as a whole was only 14.1 per cent. The states and union territories that have the highest ratio of interest payment to revenue receipts in 2020-21 are Punjab 25.8 per cent, Haryana 23.2, West Bengal 23, Kerala 21.8, Tamil Nadu 20.2 and Andhra Pradesh 18.7," added the economist.

"The government budget for advertising is bound to go up when the media becomes highly prejudiced and presents a biased picture. In such a scenario the chief ministers have no alternative but to fund their publicity campaigns using paid advertisements. Social media advertisements of the government will increase substantially in the coming years. Poll promises are aspirational slogans unless the political parties give promises of achieving precise physical targets within a fixed time frame," said Raghavan.

G.Vijayaraghavan, Kerala's foremost technocrat who was the founder CEO of country's first IT park-Technopark, here spoke the common man's point of view when he said the state government funding on infrastructure should create more jobs and economic development and rework on areas to cut wasteful expenditure.

"The Niti Aayog rating for Kerala in health and education is in comparison with the rest of the country and successive governments here can take credit for it. But the thing what many keep asking is if the state's health sector is the best, then why are those in the political and other segments going abroad for treatment. Likewise, today more and more students from Kerala are flying out for studies and all these shows a lack of confidence," said Vijayaraghavan.

He goes on to point out that the need of the hour is quality spending so quality facilities are created and wasteful expenditure has to be culled.

"Look, there are lot of areas where the political leadership can take a bold step to see that the number of state run corporations be reworked. There are a few organisations doing the same job or almost the same job and such things should be stopped and expenditure be brought down. Another thing is there are a few Labour Boards and the expenditure to maintain it is in excess of what they actually give out," said Vijayaraghavan.

Taking a political position on the topic was Leader of Opposition V.D. Satheesan who said that the state's finances are in the doldrums, owing mostly to the previous LDF government's (first Pinarayi Vijayan government 2016-21) gross mismanagement and corruption, as well as the central government's unfriendly attitude towards Kerala in devolving central funds.

"The state's per capita debt is one lakh rupees, implying that each baby born in the state is born with a burden of one lakh rupees. Though the state was expected to benefit handsomely from the implementation of GST in terms of its own tax revenue collection, gross mismanagement and corruption have forced the state to rely on the Central Government for GST compensation year after year. Furthermore, the state is saddled with KIIFB's expensive interest-bearing debts," said Satheesan.

He went on to add that the acrimonious attitude of the Union government towards the state government in devolution has stressed the already depleted state finances. The central devolution to Kerala has been tapered considerably as part of the 15th finance commission recommendations. Devolution has plummeted from 3.5 per cent during the 10th Finance Commission to 1.94 per cent now.

Disclaimer: This post has been auto-published from an agency feed without any modifications to the text and has not been reviewed by an editor

Open in app