RBI launches UPI service for feature phones

By ANI | Updated: March 8, 2022 20:45 IST2022-03-08T20:37:58+5:302022-03-08T20:45:07+5:30

The Reserve Bank of India (RBI) on Tuesday launched a unified payments interface (UPI) service for feature phones, a move which is expected to give a big boost to digital payment adoption in the country.

RBI launches UPI service for feature phones

The Reserve Bank of India (RBI) on Tuesday launched a unified payments interface (UPI) service for feature phones, a move which is expected to give a big boost to digital payment adoption in the country.

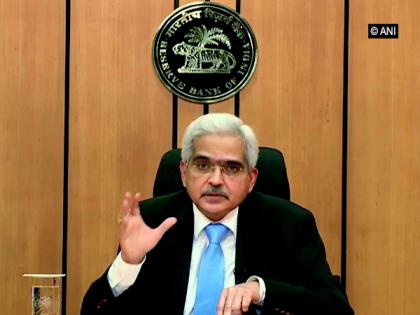

RBI Governor Shaktikanta Das launched the new initiatives called UPI123Pay and DigiSaathi. UPI123Pay gives the option to make UPI payments for feature phone users, and DigiSaathi is a 24x7 helpline to address the queries of digital payment users across products.

India has around 40 crore features phone users.

The RBI Governor said the two initiatives would help in enhancing the diversity, utility, and transformational power of digital innovations in the country.

"These initiatives will further deepen the digital ecosystem and financial inclusion," Das said.

At present, efficient access to UPI is available on smartphones. UPI can be accessed through NUUP (National Unified USSD Platform) using the short code of *99#. But this option is cumbersome and not popular. Considering that there are more than 40 crore feature phone mobile subscribers in the country, UPI123pay will materially improve the options for such users to access UPI.

Distinct features of UPI123Pay include App-based functionality, missed call, Interactive Voice Response (IVR) and Proximity Sound-based Payments.

An app would be installed on the feature phone through which several UPI functions, available on smartphones, will also be available on feature phones. Missed Call feature will allow feature phone users to access their bank account and perform routine transactions such as receiving, transferring funds, regular purchases, bill payments, etc., by giving a missed call on the number displayed at the merchant outlet. The customer will receive an incoming call to authenticate the transaction by entering UPI PIN.

The UPI payment through pre-defined IVR numbers would require users to initiate a secured call from their feature phones to a predetermined number and complete UPI on-boarding formalities to be able to start making financial transactions without an internet connection.

UPI123Pay uses sound waves to enable contactless, offline, and proximity data communication on any device.

"Initiatives are envisioned to accelerate the process of digital adoption in India, by creating a richer and inclusive ecosystem that can accommodate larger sections of population," RBI said in a statement.

( With inputs from ANI )

Disclaimer: This post has been auto-published from an agency feed without any modifications to the text and has not been reviewed by an editor

Open in app