The Invisible Burden of Debt: How Unpaid Loans and EMIs Disrupt Sleep, Peace, and Mental Health

By ANI | Updated: October 7, 2025 15:30 IST2025-10-07T15:25:04+5:302025-10-07T15:30:20+5:30

VMPL Mumbai (Maharashtra) [India], October 7: India's growing conversation on mental well-being has a new protagonistthe monthly EMIarriving on ...

The Invisible Burden of Debt: How Unpaid Loans and EMIs Disrupt Sleep, Peace, and Mental Health

VMPL

Mumbai (Maharashtra) [India], October 7: India's growing conversation on mental well-being has a new protagonistthe monthly EMIarriving on time, lingering past midnight, and eroding sleep, focus, and dignity for debt-burdened households, a trend the Economic Survey links to real productivity losses for the nation. Recent government and public data underscore the scale: mental disorders affect millions with treatment gaps as high as 70-92%, and urban metros show markedly higher prevalenceconditions that financial strain can worsen through chronic stress and anxiety. Parallel nationwide surveys report widespread sleep disruption and late bedtimes across Indian households, amplifying how stress and notifications keep minds alert when bodies need rest.

For Ratnesh, a 34-year-old warehouse supervisor, the day's noise fades only to be replaced by a quieter, sharper sound: the mental ping of a due date, the ledger he keeps in his head, and a breath that never quite reaches the bottom of his lungsclassic signs of anxiety that make sleep shallow and fragmented. He scrolls through reminders, promising to "sort it tomorrow," yet the loop continues: credit-card minimums, BNPL installments for a phone and a bike, and a personal loan taken during a health emergency, each small on paper, heavy in the chest at 2 a.m.. Studies consistently associate stress with poor sleep quality, and India's sleep surveys show large shares of adults going to bed late and waking unrefreshedan everyday productivity and health cost of carrying worry to bed.

In urban India, common mental disorders are notably higher than in rural areas, a pattern that collides with dense credit exposure and rising unsecured borrowing among the urban middle class, tightening the debt cycle for salaried workers and small entrepreneurs alike. Economists warn that for households, stacked EMIs compress savings and push families to juggle multiple loansconditions that heighten "financial anxiety India" and ripple into workplaces through distraction and absenteeism. The Survey's economic lens is blunt: mental ill-health translates into lost days and lower output, meaning the midnight math isn't just personalit's macroeconomic.

Debt stress is not only about numbers; it shows up as muscle tension, a racing mind, shallow breathing, irritability, and digestive discomfortthe body's chronic "on" switchmaking rest elusive and recovery incomplete. WHO/India notes the substantial burden of mental health problems nationally, while Indian data reflect large treatment gaps, suggesting many navigate these symptoms without structured help, particularly in cities where prevalence is higher and the pace faster. In this landscape, "EMI stress" becomes a nightly rehearsal: eyes closed, mind calculating, heart counting down to due dates.

"The rising incidence of anxiety and depression in India is deeply worrying, and behind every statistic is a person losing sleep, peace of mind, and dignity. We need to recognise the unique struggles people face and ensure they get the right structured support. Only by meeting people where they are can we begin to make real progress on the larger mental health crisis." - DisketAngmo, Lead, Mann Talks

From aspirational gadgets to unavoidable medical bills, easy credit creates an illusion of affordability that can harden into a "debt cycle," especially when incomes are flat and expenses rise, leaving little buffer for shocks.

Debt has quietly become one of the biggest stressors for India's middle class. What begins as manageable credit card bills or easy BNPL EMIs often snowballs into multiple high interest loans, sleepless nights, strained families, and declining productivity. It's time we acknowledge this as both an economic and mental health challenge. Harish Parmar, Founder, SingleDebt

Analysts point out that as households lean on credit, defaults among small borrowers rise and productivity can slipan echo of the Survey's warning that mental health and economic performance are tightly linked. Underneath the numbers are families postponing care, skipping rest, and stretching workdays to keep pace with installmentsdebt and mental health India intertwined in daily routines.

Managing debt-related stress begins with protecting your nights. Fixing a wind-down routine, dimming screens an hour before bed, and silencing EMI notifications after a set time can help safeguard sleep. Writing down all EMIs, interest rates, and payment dates on a single page reduces rumination and provides mental clarity. When worry feels overwhelming, seeking support from mental health professionals is vital, as early intervention for anxiety, sleep issues, and stress is strongly recommended by experts. Debt counselling can also offer neutral guidance in restructuring payments, prioritising high-interest loans, and setting realistic financial buffers, easing financial anxiety without stigma.

India's Economic Survey has, for the first time, placed mental health in the economic conversation, acknowledging that well-being shapes the country's growth path and the future of its workforce. For households living with EMI stress, this recognition matters: it reframes night-time worry as a public-health and productivity issue, not a personal failing, and invites practical supportfrom counselling rooms to policy roomsto let families sleep, work, and live with steadier hearts.

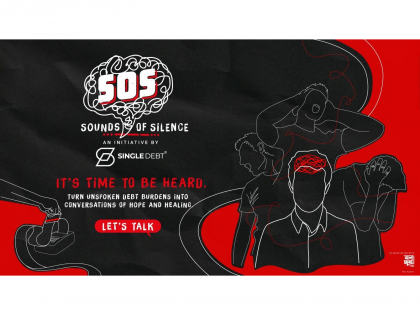

This is also why initiatives like Sounds of Silence (SOS) by SingleDebt in association with Mann Talks, have emerged during Mental Health Week. The initiative offers free and confidential relief through an on-call helpline (+91 96191 03594) connecting individuals with trained mental health professionals to talk openly about debt-related anxiety. It combines financial and psychological counselling so people don't have to choose between money and mind, and provides simple mindfulness tools and audio guides to ease restlessness and reclaim calm in daily life. Alongside this, a growing repository of blogs and resources helps borrowers identify financial and mental health challenges while staying aware of their rights.

In a city of lit windows, the sounds of silence should be rest, not racing thoughts and that shift begins when support is both visible and safe to reach.

(ADVERTORIAL DISCLAIMER: The above press release has been provided by VMPL.will not be responsible in any way for the content of the same.)

Disclaimer: This post has been auto-published from an agency feed without any modifications to the text and has not been reviewed by an editor

Open in app