New GST Rates: Launching on the First Day of Navratri, Reforms Bring a ‘True Double Bonanza,’ Says PM Narendra Modi

By Lokmat Times Desk | Updated: September 22, 2025 13:11 IST2025-09-22T13:10:02+5:302025-09-22T13:11:21+5:30

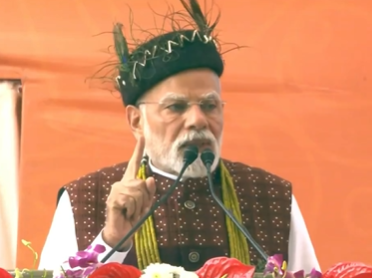

Addressing the masses at Itanagar, Arunachal Pradesh, on the first day of Shradiya Navaratri spoke about the new GST ...

New GST Rates: Launching on the First Day of Navratri, Reforms Bring a ‘True Double Bonanza,’ Says PM Narendra Modi

Addressing the masses at Itanagar, Arunachal Pradesh, on the first day of Shradiya Navaratri spoke about the new GST reforms being implemented from September 22. He said that people will get a true double bonanza during this festive season. Addressing the gathering, PM Modi said, “With the launch of GST reforms on the first day of Navratri, people will receive 'true double bonanza' this festive season.” PM Modi further said that the Congress government kept increasing the taxes. He said, “Congress govt kept on increasing taxes even as everything got expensive. The latest GST reforms will reduce the kitchen budget, helping women.”

With launch of GST reforms on first day of Navratri, people will receive 'true double bonanza' this festive season: PM Modi.

— Press Trust of India (@PTI_News) September 22, 2025

Congress neglected Arunachal as it has only 2 Lok Sabha seats, which caused lot of damage and left state behind in development: PM. pic.twitter.com/1k03hVOsI6

Congress govt kept on increasing taxes even as everything got expensive, alleges PM Modi at rally in Arunachal.

— Press Trust of India (@PTI_News) September 22, 2025

Latest GST reforms will reduce kitchen budget, helping women: PM Modi in Itanagar.

Border villages neglected by Congress govt leading to migration, we changed this:… pic.twitter.com/1HyYY4k6Kn

Bringing festive cheer, the Modi government’s next-generation GST reforms officially come into effect from today, September 22, 2025. With these changes, several household essentials, cars, two-wheelers, and televisions will now be more affordable for the middle class and common citizens. A wide range of food items—such as roti, parantha, paneer, and khakra—have been shifted to the NIL or 0% tax bracket. In a major relief, health and life insurance premiums are now fully exempt from GST.

The revised GST structure, unveiled earlier this month by Finance Minister Nirmala Sitharaman, simplifies the tax regime by bringing it down to two key slabs—5% and 18%. While most goods have benefited from tax reductions, a few categories will now attract higher rates. For instance, clothing priced above ₹2,500 will face an 18% GST, up from the previous 12%. Over 50 common food products, including UHT milk, khakhras, pre-packaged paneer, chapatis, and parathas, have moved into the zero-tax category. In healthcare, 33 critical drugs and therapies for cancer and rare diseases are now GST-free, while rates on several other medicines have been cut from 12% to nil. Medical equipment like diagnostic kits and glucometers will now attract just 5% GST.

The new structure also eases costs for students and offices, with items such as pencils, erasers, notebooks, and maps exempted. Popular staples like butter, biscuits, condensed milk, namkeen, jams, ketchup, juices, ghee, ice cream, and sausages will see reduced prices. Dry fruits, including almonds, cashews, pistachios, and dates, are now taxed at 5%, down from 12%.

Housing will benefit too, as GST on cement has been lowered to 18% from 28%. Services such as haircuts, salons, gyms, yoga classes, and health clubs will also become cheaper. Toiletrie,s including soaps, shampoos, hair oils, face creams, and shaving creams have entered the zero-tax slab.

Large household appliances and electronics—air conditioners, televisions, washing machines, and dishwashers—will now attract 18% GST instead of 28%.

To balance revenue, the government has merged cess into the GST framework and introduced a 40% levy on sin and luxury goods. Tobacco products such as cigarettes, bidis, gutka, pan masala, and aerated beverages like Coca-Cola, Pepsi, and Fanta will face the steepest tax rates.

Meanwhile, large SUVs and multipurpose vehicles above 1,200cc (petrol) or 1,500cc (diesel) and over four metres in length will be taxed at 40%, replacing the earlier 28% GST plus 22% cess.

Open in app