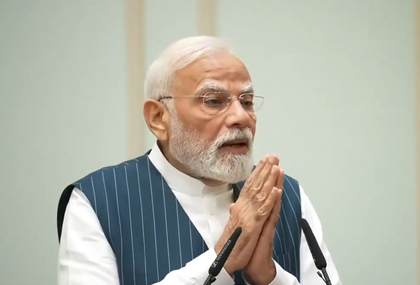

Next Gen GST reforms are double dose of support and growth: PM Modi

By IANS | Updated: September 4, 2025 20:45 IST2025-09-04T20:40:41+5:302025-09-04T20:45:23+5:30

New Delhi, Sep 4 Prime Minister Narendra Modi on Thursday said that the "next generation" GST reforms that ...

Next Gen GST reforms are double dose of support and growth: PM Modi

New Delhi, Sep 4 Prime Minister Narendra Modi on Thursday said that the "next generation" GST reforms that have been rolled out are a "double dose of support and growth" to propel India’s progress in the 21st century.

The Prime Minister pointed out that the quality of life of Indian citizens will improve, and consumption and growth will get a fresh booster dose with the GST reforms. The enhanced ease of doing business will give a boost to investments and employment, he added.

Taking a dig at the previous Congress governments, he said they had levied high taxes on kitchen items as well as goods related to farming and agriculture and even medicines.

He pointed out that another benefit for the youth is going to be in the fitness sector as GST has been reduced on services like gyms, salons and yoga centres.

The latest reforms mark a major simplification of the GST structure, which will kick in on September 22. The shift to a two-slab system of 5 per cent and 18 per cent, removing the earlier 12 per cent and 28 per cent rates, will make taxation more transparent and easier to follow, according to an official statement.

At the same time, a 40 per cent tax on luxury and sin goods such as pan masala, tobacco, aerated drinks, high-end cars, yachts, and private aircraft ensures fairness and revenue balance.

Alongside, registration and return filing have been simplified, refunds made faster, and compliance costs reduced, easing the burden on businesses, especially MSMEs and startups.

A sector-wise follow-up of the reforms and their expected impact shows that there will be gains across the board that will make goods cheaper, drive up demand and spur economic growth and the creation of more jobs in the economy.

The reforms bring direct savings to households by reducing taxes on everyday essentials and packaged foods. The GST rate cut on ACs, dishwashers and TVs (LCD, LED) from 28 per cent to 18 per cent is a dual win. It increases affordability for consumers while strengthening India’s electronics manufacturing ecosystem, the statement explained.

Products like Ultra-High Temperature (UHT) milk, pre-packaged and labelled chena or paneer and all the Indian breads will see nil rates.

Household goods like soaps, shampoos, toothbrushes, toothpaste, tableware, and bicycles are now at 5 per cent. Food items such as packaged namkeens, bhujia, sauces, pasta, chocolates, coffee, preserved meat, etc., have also been reduced to 5 per cent from 12 per cent or 18 per cent earlier

The cut in GST on cement from 28 per cent to 18 per cent and construction materials such as marble and granite from 12 per cent to 5 per cent will give a big boost to the housing sector. This will lower the cost of homes and infrastructure projects, making ownership of houses more affordable. The move is also expected to spur demand in real estate and create new jobs in construction.

Clearer classification of vehicles and auto parts will cut down disputes, improve compliance, and support growth in India’s automotive manufacturing and exports. The GST on small cars, two-wheelers of 350cc or less, buses, trucks and three-wheelers has been cut to 18 per cent from 28 per cent, which will boost the automobile sector.

Similarly, the agricultural sector will also get a big push as the GST on farm machinery has been reduced to 5 per cent from 12 per cent, and lower rates on bio pesticides will help small farmers reduce costs and encourage sustainable farming practices. Correcting the inverted duty structure on fertiliser inputs will boost domestic fertiliser production and reduce dependence on imports, strengthening self-reliance in agriculture.

GST on tractors, harvesters, threshers, sprinklers, drip irrigation, poultry & bee-keeping machines have all been reduced to 5 per cent from 12 per cent earlier.

In the cases of the services sector, lower GST on hotel stays, gyms, salons, and yoga services will reduce costs for citizens, improve access to wellness, and give a fillip to the hospitality and service industries. GST hotel stays up to Rs 7,500/day have been cut from 12 per cent to 5 per cent. Besides gyms, salons, barbers, and yoga have seen a GST cut from 18 per cent to 5 per cent.

Fixing duty structures for man-made fibres will improve the competitiveness of the textile industry, especially in exports. The inverted duty structure in the sector has been corrected with a reduction of GST rate on manmade fibre from 18 per cent to 5 per cent and manmade yarn from 12 per cent to 5 per cent.

Further, lower GST rates on handicrafts will support artisan livelihoods, preserve India’s cultural heritage, and promote rural economic growth.

Education has also become more affordable with exercise books, erasers, pencils, crayons and sharpeners moving to 0 per cent GST. This directly supports families and students, ensuring lower costs of learning materials. Geometry boxes, school cartons, and trays will attract a 5 per cent duty instead of 12 per cent earlier.

Reduced rates on medicines and medical devices will improve access to healthcare and support domestic manufacturing in the pharma and medical equipment sectors. The GST on 33 life-saving drugs and diagnostic kits has been reduced to zero.

Other medicines, including ayurveda, unani, homoeopathy, and spectacles and corrective goggles, have been brought into the lowest 5 per cent bracket.

Similarly, GST exemptions on life and health insurance premiums will expand financial protection and support the vision of Mission Insurance for All by 2047, the statement added.

Disclaimer: This post has been auto-published from an agency feed without any modifications to the text and has not been reviewed by an editor

Open in app