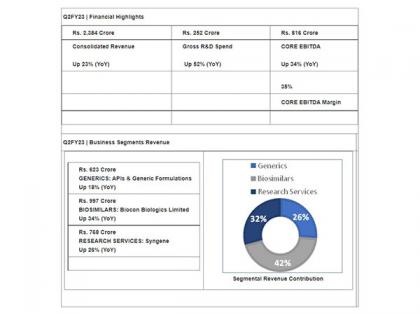

Biocon Q2FY23 Revenue at Rs 2,384 Cr., Up 23 percent; Core EBITDA at Rs 816 Cr., Up 34 percent Gross R&D Spend at Rs 252 Crore, Up 52 percent

By ANI | Published: November 15, 2022 01:19 PM2022-11-15T13:19:03+5:302022-11-15T18:50:29+5:30

Biocon Ltd. (BSE code: 532523, NSE: BIOCON), an innovation-led global biopharmaceuticals company, today announced its consolidated financial results for the second quarter ended September 30, 2022.

Biocon Q2FY23 Revenue at Rs 2,384 Cr., Up 23 percent; Core EBITDA at Rs 816 Cr., Up 34 percent Gross R&D Spend at Rs 252 Crore, Up 52 percent

Biocon Ltd. (BSE code: 532523, NSE: BIOCON), an innovation-led global biopharmaceuticals company, today announced its consolidated financial results for the second quarter ended September 30, 2022.

Leadership Comments

Biocon Group

"We reported a strong consolidated revenue growth of 23 per cent YoY for Q2FY23 at Rs. 2,384 Crore driven by 34 per cent growth in Biosimilars, 26 per cent in Research Services and 18 per cent in the Generics business. Our Gross R&D spends increased by 52 per cent YoY this quarter to Rs. 252 Crore reflecting our advancing pipeline that will drive our future growth. Core EBITDA was up by 34 per cent at Rs. 816 Crore, representing healthy core operating margins of 35 per cent versus 33 per cent in the same quarter last year.

"We have delivered a resilient performance in H1FY23, with all segments delivering strong revenue growth. We expect to consolidate on this performance in the second half of FY23. Enhanced capacities and new launches will drive growth for our API and Generic Formulations business, while continued business momentum should help Syngene achieve its guidance for the full year.

"The consolidation of Viatris' global biosimilars business and the strategic vaccines alliance with Serum Institute will add to the growth of the Biosimilars business in H2FY23. We have secured necessary financing and obtained relevant approvals for the Viatris transaction, which is expected to close shortly." - Kiran Mazumdar-Shaw, Executive Chairperson, Biocon and Biocon Biologics.

Biocon Generics

"I am pleased with the sequential as well as YoY growth of the Generics business in Q2, on the back of the stabilization of our API business, with immunosuppressants being a significant contributor. Our statins portfolio continued to encounter pricing pressures.

"Our Generic Formulations business delivered a healthy performance in the quarter, with both base business as well as new product launches gaining traction. The business also secured several key approvals for our vertically integrated products in the EU and the rest of the world (RoW) markets, providing further impetus to our geographical expansion plans in the quarters ahead. - Siddharth Mittal, CEO & Managing Director, Biocon.

Biocon Biologics

"Biocon Biologics maintained a healthy operating performance in Q2FY23 with revenues increasing 34 per cent YoY to Rs. 997 Crore, driven by higher sales of our biosimilar insulins and antibodies in advanced and emerging markets. We have seen an uptick in new prescription share for Semglee and volume market share for Fulphila in the U.S. Core EBITDA at Rs. 449 Crore was up 48 per cent YoY, representing strong margins of 46 per cent. R&D investments at Rs. 184 Crore, an increase of 142 per cent YoY, reflects the good progress of our pipeline laying the foundation for future growth of our business.

"In preparation for a direct commercial presence in the advanced markets, we have made key leadership appointments this quarter. We believe the conclusion of the strategic transactions with Viatris and Serum Institute, expected to be closed in Q3FY22, will position Biocon Biologics as a fully integrated, leading global biosimilars player." - Dr Arun Chandavarkar, Managing Director, Biocon Biologics.

Syngene

"Our performance in the first half of the year was good. We started the year with strong momentum and delivered a robust first quarter. Performance in the second quarter was ahead of market expectations. All our divisions performed well and revenue from operations grew by 26 per cent. We continue to see good demand for our services, which has helped us deliver strong revenue growth and puts us on a solid track for the rest of the year." - Jonathan Hunt, CEO & Managing Director, Syngene.

Awards & Recognitions

Biocon (including Biocon Biologics) improved its ESG score to 52 from 45 in the previous year in the 2022 S&P Global Corporate Sustainability Assessment released in October on the back of key initiatives undertaken during the past year.

Biocon (including Biocon Biologics) has been named among the Top 10 global employers in the biotech, pharma and biopharma sectors by the U.S.-based prestigious Science magazine. Biocon has been in the Top 20 global biotech employers ranking since 2012.

Biocon Biologics has been recognized for world class Intellectual Property (IP) management and IP value creation in the Asia-Pacific region and included on the prestigious Asia IP ELITE list for 2022.

Financial Highlights (Consolidated): Q2FY23

In Rs Crore

Figures above are rounded off to the nearest Crore; per cent based on absolute numbers.

#Includes Licensing income. *Core EBITDA is EBITDA net of R&D expense, licensing, forex, dilution gain in Bicara, mark-to-market movement on investments.

^ Exceptional items during Q2 FY23 comprise MAT credit balance charge of Rs. 107 Cr on adoption of new tax regime of 25 per cent and Professional fees, net of tax of Rs. 14 Cr towards the Viatris deal

Corporate Updates

Tribute to John Shaw, Former Vice Chairman of Biocon

John Shaw, former Vice Chairman of Biocon and husband of our Chairperson, Kiran Mazumdar-Shaw, passed away on October 24, 2022, in Bengaluru. As a key member of the Board and the management team of Biocon since 1999, John Shaw has contributed majorly to the transformation of Biocon into a globally recognized, innovation-led biopharmaceutical company. In his 22 years with Biocon, he played a very important role in building the Company, ensuring the highest levels of corporate governance, as well as contributing to the financial and strategic development of the Biocon Group. He retired from the Board of Directors of Biocon on July 23, 2021, due to health reasons.

John Shaw was a man who stood tall with his values and inspired many. He was a very benevolent, erudite and a compassionate person who truly believed in philanthropy to make this world a better place. John Shaw's vision for Biocon will continue to guide us towards our purpose of enabling equitable access to healthcare worldwide.

Board Appointment

Biocon has appointed Peter Bains as Additional Director (Category - Independent) to its Board, subject to the completion of necessary formalities under the Companies Act.

He has over three decades of experience in biopharmaceuticals, with a successful track record of building brands, businesses, teams and companies. Peter currently serves as a Non-Executive Director on the Board of Indivior PLC, a UK FTSE-listed pharmaceuticals company, as well as MiNA Therapeutics and Apterna, both privately held UK biotech companies.

Biocon Improves its 2022 ESG Score

Biocon (including Biocon Biologics) improved its ESG score to 52 from 45 in the previous year in the recently released S&P Global Corporate Sustainability Assessment report. This was accomplished on the back of key initiatives undertaken during the past year, leading to improvement in our Environmental, Social and Governance (ESG) practices, details of which were published in, which is available on

ESG is at the core of our business purpose and responsibility. By serving patients, protecting the environment and promoting business integrity, we are reinforcing our commitment to building an equitable and viable future.

Business Highlights

GENERICS: APIs & Generic Formulations

Q2FY23 revenue at Rs. 623 Crore, up 18 per cent (YoY) from Rs. 530 Crore in Q2FY22.

Business Performance

During the quarter we launched two important products Sitagliptin and Vildagliptin in the EU, enabled by the brownfield capacity expansions undertaken at our Bengaluru and Visakhapatnam facilities.

The Company also received five product approvals across markets. In the EU, we obtained three approvals, for Posaconazole, our vertically integrated anti-fungal drug; Lenalidomide, an oncology product, and for Everolimus, used in the treatment of certain types of cancers and tumors. In the UK, we received an approval for Posaconazole. We also received approvals in the UAE for Mycophenolic acid delayed release tablets 360 mg, indicated for the prophylaxis of organ rejection in adult patients receiving kidney transplants.

Commissioning and Qualification of our immunosuppressants facility at Visakhapatnam and peptides facility at Bengaluru have been completed and process validation of batches will commence in the current quarter.

BIOSIMILARS: Biocon Biologics Ltd. (BBL)

Q2FY23 revenue at Rs. 997 Crore, up 34 per cent (YoY) from Rs. 743 Crore in Q2FY22.

Served ~5.3 million patients (MAT Sep 2022 basis)##.

Business Performance

Biocon Biologics' YoY revenue growth was led by a strong performance of its biosimilars portfolio in advanced and emerging markets.

Continued progress on two of BBL's own research assets, bDenosumab and bUstekinumab, which are undergoing global clinical trials, as well as other pipeline molecules, raised BBL's R&D investments this quarter by 142 per cent YoY to Rs. 184 Crore, representing 18 per cent of BBL revenue.

Core EBITDA (excluding R&D, forex, licensing income and mark-to-market loss on investments) stood at Rs. 449 Crore, reflecting a growth of 48 per cent YoY. Core EBITDA margin was at 46 per cent for the quarter versus 42 per cent last year. EBITDA for the quarter at Rs 214 Crore was impacted by higher R&D investments and non-cash foreign currency translational loss of Rs 35 Crore pertaining to Goldman Sachs' OCD investment in BBL. Profit Before Tax and Exceptional Items stood at Rs 78 Crore.

Advanced Markets

In Q2FY23, the Viatris-led advanced markets business reported strong year-on-year growth on the back of improved performance by interchangeable bGlargine (Semglee), which reported an uptick in new prescription share of 14 per cent and overall prescription share of 12 per cent (week ended October 14, 2022).

Increased uptake of Fulphila in the U.S. with market share surpassing 10 per cent, despite increasing competition.

Ogivri continues to be the leading bTrastuzumab brand in Canada and Australia with over 30 per cent market share in both.

This story has been provided by NewsVoir.will not be responsible in any way for the content of this article. (ANI/NewsVoir)

( With inputs from ANI )

Disclaimer: This post has been auto-published from an agency feed without any modifications to the text and has not been reviewed by an editor

Open in app