Boost for Anil-Ambani Group: Share Price Of Reliance Power and Reliance Infra Jump By 3%

By Lokmat Times Desk | Updated: August 11, 2025 11:29 IST2025-08-11T11:28:36+5:302025-08-11T11:29:43+5:30

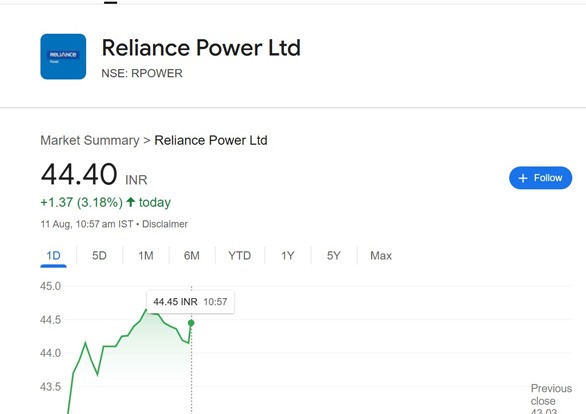

Shares of Anil Ambani-led companies surged by 3% on Monday, with a rise of 44.56 INR (+3.56%) and 279.00 ...

Boost for Anil-Ambani Group: Share Price Of Reliance Power and Reliance Infra Jump By 3%

Shares of Anil Ambani-led companies surged by 3% on Monday, with a rise of 44.56 INR (+3.56%) and 279.00 INR (+2.05%), despite an ongoing investigation into a suspected Rs 17,000 crore loan fraud. After years of being written off, a clutch of Anil Ambani Group stocks is suddenly back in the spotlight. Shares of companies like Reliance Power and Reliance Infrastructure have surged sharply recently, drawing interest from retail investors. The rally comes on the back of a series of positive developments, including withdrawals from insolvency proceedings, debt reduction, earnings boosts, and a push for clean energy.

On Friday, Reliance Infrastructure received a major boost after the Supreme Court allowed its subsidiaries, BSES Yamuna Power and BSES Rajdhani Power, to recover about Rs 28,483 crore in regulatory assets over the next four years.The Delhi Electricity Regulatory Commission (DERC) has approved these assets, with recovery from consumers—likely through higher electricity tariffs—scheduled to begin on April 1, 2024. The dues arise from past tariff gaps, where regulator-approved electricity prices fell short of covering the full cost of supply.

Last week, shares of both the Anil Ambani led companies hit lower circuit after the Directorate of Enforcement (ED) summoned Anil Ambani. Shares of Reliance Power dropped 4.16% to their day’s low of Rs 50.65 on the BSE, while Reliance Infrastructure slid nearly 5% to an intraday low of Rs 312. The companies and investments that led to the downfall, staging a silent but forceful comeback- Reliance Power and Reliance Infrastructure — have been the cynosure of investor attention. Reliance Power and Reliance Infrastructure are now completely debt-free and churning out profits.

Reliance Power in its Q1 results reported a consolidated net profit of Rs 44.68 crore for the first quarter ended June 2025. With this, the company swung into profit as it had reported a consolidated net loss of Rs 97.85 crore in the corresponding quarter of last financial year. Despite the profit recovery on YoY basis, the firm’s net profit dropped 64 per cent on sequential basis as compared to a profit of Rs 125.57 crore in the March quarter. The Reliance Group company currently has a market cap of Rs 26,502.02 crore and was established to develop, construct, operate and maintain power projects in the Indian and international markets.The company plans to raise funds through the issuance of equity shares or equity linked instruments to qualified institutional buyers (QIBs). The company's board also approved issuance of secured/unsecured, redeemable, non-convertible debentures up to Rs 3,000 crore, in one or more tranches, on a private placement basis or otherwise.

Open in app