Institutional credit to agriculture grows nearly 4 times to Rs 27.5 lakh cr in 11 years

By IANS | Updated: June 7, 2025 14:13 IST2025-06-07T14:08:59+5:302025-06-07T14:13:18+5:30

New Delhi, June 7 In the last 11 years under the Prime Minister Narendra Modi’s government, institutional credit ...

Institutional credit to agriculture grows nearly 4 times to Rs 27.5 lakh cr in 11 years

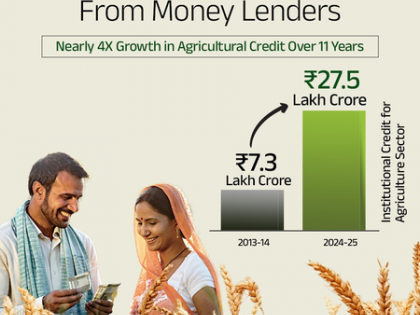

New Delhi, June 7 In the last 11 years under the Prime Minister Narendra Modi’s government, institutional credit to agriculture has surged from Rs 7.3 lakh crore to Rs 27.5 lakh crore, the Ministry of Finance said on Saturday.

Under the leadership of PM Modi, farmer-first governance has led to a historic surge in support prices, timely credit, and record payouts — ensuring security and stability for every cultivator, the minister said in a post on X social media platform.

“PM Modi ensured no ‘annadata’ is left waiting for timely financial support with institutional credit to agriculture nearly quadrupling — from Rs 7.3 lakh crore in 2013-14 to Rs 27.5 lakh crore in 2024-25,” the ministry further stated.

From marginal fields to global shelves India’s farmers are rising like never before.

Since 2014, under PM Modi’s leadership, “our ‘annadatas’ have gained dignity, income support, MSP assurance, agri-infra, and global market access,” according to the government.

Kisan Credit Card (KCC) scheme has also become a lifeline for millions of farmers.

KCC is a banking product that provides farmers with timely and affordable credit for purchasing agricultural inputs such as seeds, fertilisers, and pesticides, as well as for meeting cash requirements related to crop production and allied activities.

“Over 465 lakh applications have been sanctioned with Rs 5.7 lakh crore credit limit,” according to Finance Minister Nirmala Sitharaman.

The scheme has led to “easy access to short-term crop loans”. About Rs 5.7 lakh crore have also been sanctioned in credit, with “interest as low as 4 per cent with timely repayment”.

With the KCC scheme, farmers can get up to Rs 3 lakh loan at just 4 per cent interest, if repaid on time.

An additional Prompt Repayment Incentive of 3 per cent is also being provided to farmers on timely repayment of loans, which effectively reduces the rate of interest to 4 per cent for farmers. Thus, for every one lakh KCC loan, farmers can save up to Rs 9,000 in interest per year.

Disclaimer: This post has been auto-published from an agency feed without any modifications to the text and has not been reviewed by an editor

Open in app