HDFC to sell 10 per cent stake in HDFC Capital to ADIA for Rs 184 crore

By ANI | Published: April 20, 2022 12:38 PM2022-04-20T12:38:43+5:302022-04-20T12:45:18+5:30

Mortgage lender HDFC Ltd said on Wednesday it has entered into binding agreements to sell 10 per cent of its equity stake in HDFC Capital Advisors Ltd (HDFC Capital) to Abu Dhabi Investment Authority (ADIA) for Rs 184 crore.

HDFC to sell 10 per cent stake in HDFC Capital to ADIA for Rs 184 crore

Mortgage lender HDFC Ltd said on Wednesday it has entered into binding agreements to sell 10 per cent of its equity stake in HDFC Capital Advisors Ltd (HDFC Capital) to Abu Dhabi Investment Authority (ADIA) for Rs 184 crore.

ADIA is also the primary investor in the alternative investment funds managed by HDFC Capital.

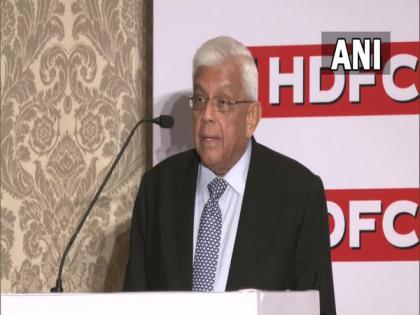

"Six years ago we set up HDFC Capital with a vision of progressing in sync with the government's 'Housing for All' goal by increasing the supply of affordable homes in India. Supported by marquee global investors like ADIA, the funds managed by HDFC Capital have grown to create one of the world's largest private financing platforms for the development of affordable housing," Deepak Parekh, Chairman, HDFC Ltd, said in a statement.

"This investment by ADIA will enable HDFC Capital to leverage ADIA's global expertise and experience to further propel HDFC Capital towards becoming a leading investment platform for global and local investors across multiple strategies and asset classes in the real estate and technology ecosystem," Parekh said.

Set up in 2016, HDFC Capital is the investment manager to HDFC Capital Affordable Real Estate Funds 1, 2 & 3; and is aligned with the Government of India's goal to increase housing supply and support the Pradhan Mantri Awas Yojana - 'Housing for All' initiative.

HDFC Capital manages an approximately $3 billion funding platform which has recently been rated as one of the world's largest private finance platforms focused on the development of affordable housing.

The funds managed by HDFC Capital provide long-term, flexible funding across the lifecycle of affordable and mid-income housing projects including early-stage funding. In addition, the funds will also invest in technology companies (construction technology, fin-tech, clean-tech etc.) engaged in the affordable housing ecosystem.

Commenting on the deal Mohamed Al Qubaisi, Executive Director of the Real Estate Department, ADIA, said, "HDFC Capital is one of India's leading providers of affordable housing project finance, with an established track record of supporting the development of new residential stock across the country."

"This agreement builds on our successful investments in the H-CARE funds and underlines our belief in the positive long-term outlook for affordable and mid-market housing in India," he said.

HDFC Capital's target is to finance the development of one million affordable homes in India through a combination of innovative financing, partnerships, and technology, whilst focusing on sustainability. In order to achieve this objective, the company is in active discussions with leading global investors to raise additional funds to be invested in the development of affordable & mid-income housing projects in India, the company said in a statement.

( With inputs from ANI )

Disclaimer: This post has been auto-published from an agency feed without any modifications to the text and has not been reviewed by an editor

Open in app