RBI Governor says it's not regulator's job to take decisions for bank boards

By IANS | Updated: November 7, 2025 13:25 IST2025-11-07T13:23:43+5:302025-11-07T13:25:10+5:30

Mumbai, Nov 7 Stressing that Indian banks are far more mature today than they were a decade ago, ...

RBI Governor says it's not regulator's job to take decisions for bank boards

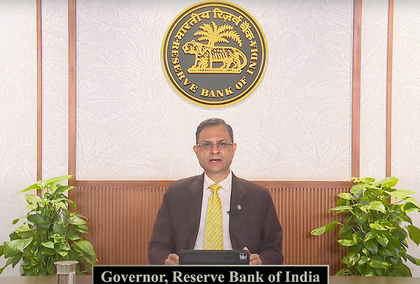

Mumbai, Nov 7 Stressing that Indian banks are far more mature today than they were a decade ago, RBI Governor Sanjay Malhotra said on Friday that the Central Bank does not aim to micromanage things, adding that no regulator should substitute for boardroom judgment and each case has to be looked at with merit by a regulated entity.

Addressing the State Bank of India’s (SBI) Banking and Economics Conclave here in the financial capital, he said regulators need to keep in mind the credit and deposits expansion, improved asset quality and profitability, along with surge in returns on assets and equity.

He further stated that we need to allow the regulated entities to take decisions based on the merits of each case.

According to Malhotra, the role of a regulator is like “a gardener” and Central Bank also monitors the growth of a plant and prunes unwanted growth to "shape a collective, orderly, beautiful garden".

Last month, the RBI unveiled 22 measures, including allowing banks to finance acquisitions, increasing limits on loans against shares, and laying out draft norms for transitioning to expected credit loss (ECL) framework for loan loss provisioning.

According to Malhotra, the RBI is aiming to make rule-making more open, driven by data and evidence, after due public consultation, adding that supervisory actions have enabled effective backstop to moderate or prune unsustainable growth and shape a robust, resilient and beautiful banking system.

He further stated that the SBI which is India’s largest public sector lender, has transformed from being in loss in 2018 to now becoming a $100 billion company due to the regulatory and structural reforms.

The introduction of the Insolvency and Bankruptcy Code (IBC) in 2016 and the resolution mechanisms established under the Pursuant Resolution Paradigm through out-of-court workout frameworks have fundamentally transformed India's credit culture, he mentioned.

Disclaimer: This post has been auto-published from an agency feed without any modifications to the text and has not been reviewed by an editor

Open in app