Tax Saving Tips: Last minute tax saving investment, where to save tax, how much tax to get, find out

By Lokmat English Desk | Published: March 27, 2022 12:14 PM2022-03-27T12:14:20+5:302022-03-27T12:14:20+5:30

The last phase of the financial year 2021-22 is underway. The current financial year is in its final stages. Therefore, if you want to make any last minute decision regarding investment and tax saving, this work has to be done before 31st March.

These tax saving schemes offer positive returns for tax savings when considering investments. The interest rate on a savings bank account is around 4%. The average inflation is above 5 percent. In such a case the money kept in savings is a negative return.

ELSS (Equity Linked Savings Scheme) is the best scheme for investing. The benefit of deduction under section 80C is available on investment. The limit is Rs 1.5 lakh. His lock period is 3 years. Long term investment in Financial Expert

In case of PPF, it provides relief under Section 80C. During this period, PPF earns 7.1 per cent interest. And interest income is completely tax free. Public Provident Fund accounts mature in 15 years. At least 5 of these

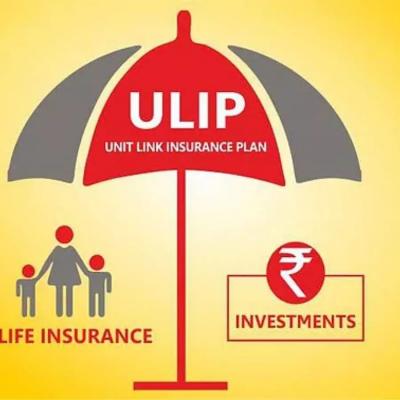

ULIP ULIP also means that when you invest in a unit linked insurance plan you get the benefit of investing in equity along with life insurance. It pays off in part. Part of the investment is invested and the rest is invested in equity. So you

The national payment system is the best option for retirement. This is a social security scheme. In which government, private and unorganized sector workers can participate. It gives an annual return of 8 to 10 percent. Under Section 80C when investing in NPS