Sovereign wealth funds infuse Rs 8,426 crore into India in FY25

By IANS | Updated: August 18, 2025 15:05 IST2025-08-18T14:56:06+5:302025-08-18T15:05:11+5:30

New Delhi, Aug 18 India remained a strong magnet for long-term investors in FY25, with sovereign wealth funds ...

Sovereign wealth funds infuse Rs 8,426 crore into India in FY25

New Delhi, Aug 18 India remained a strong magnet for long-term investors in FY25, with sovereign wealth funds (SWFs) infusing a net Rs 8,426 crore into the country, the Parliament was informed on Monday.

The steady inflows underline global investors’ confidence in India’s growth story.

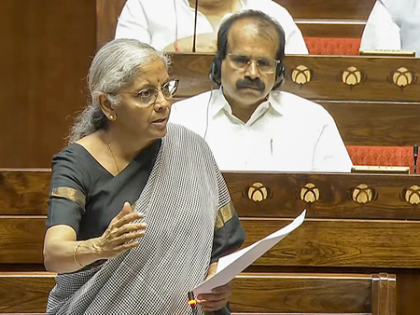

In FY24, the funds had brought in a much higher Rs 47,604 crore, while FY23 had also witnessed solid inflows of Rs 15,446 crore, Union Finance Minister Nirmala Sitharaman said in a written reply to a question in the Lok Sabha.

The only exception came in FY22, when there was a net outflow of Rs 3,825 crore. Over the past few years, global sovereign and pension funds have shown sustained interest in India -- underlining its position as one of the most promising emerging markets.

Among sectors, financial services attracted the highest inflows at Rs 28,562 crore between FY22 and FY25, followed by IT with Rs 19,135 crore, healthcare with Rs 7,830 crore and telecom with Rs 7,053 crore.

These sectors reflect India’s strength in technology, digital infrastructure, and healthcare innovation.

Experts note that such steady inflows are significant as they represent patient, long-term capital that supports India’s development journey.

With the government pushing for reforms, infrastructure growth, and digital expansion, India is expected to remain an attractive destination for global funds in the years ahead.

The Finance Minister said while FDI inflows from SWFs and pension funds are not separately tracked, their portfolio investments are monitored sector-wise.

She added that the government has offered tax exemptions, regulatory relaxations, and eased FDI rules to attract long-term foreign investors.

“Currently, more than 95 per cent of FDI inflows come via the automatic route, with the Union Budget 2025 also raising the FDI cap in insurance to 100 per cent from 74 per cent,” FM Sitharaman noted.

Disclaimer: This post has been auto-published from an agency feed without any modifications to the text and has not been reviewed by an editor

Open in app